It’s November. Can you believe it? The month of Thanksgiving, family, and the start of the holiday season. Thanksgiving is my very favorite holiday so I’m quite excited about this month. I am thankful for you, dear reader, and I wish you a blessed Thanksgiving holiday.

LET’S TALK ABOUT RETIREMENT

I know some of you are in your 20s and 30s and retirement is not top of mind for you. May I be so bold as to say that it should be? According to the 2019-2020 Federal Reserve SCF Data, the average retirement savings by age group looks like this:

- Ages 18-24: $4,745.25

- Ages 25-29: $9,408.51

- Ages 30-34: $21,731.92

- Ages 35-39: $48,710.27

- Ages 40-44: $101,899.22

- Ages 45-49: $148,950.14

- Ages 50-54: $146,068.38

- Ages 55-59: $223,493.56

- Ages 60-64: $221,451.67

- Ages 65-69: $206,819.35

What comes to your mind when you see these numbers? How does your retirement savings stack up against these numbers?

The under-40 crowd still has plenty of time to invest and reap the benefits of compound interest, but the retirement picture for those who are over 40 is less than cheery. For those under 40, and especially for people in their 20s, I want to encourage you to begin TODAY investing for retirement out of each paycheck. Dave Ramsey recommends that you invest 15% of your income into solid mutual funds. I like Dave’s plan.

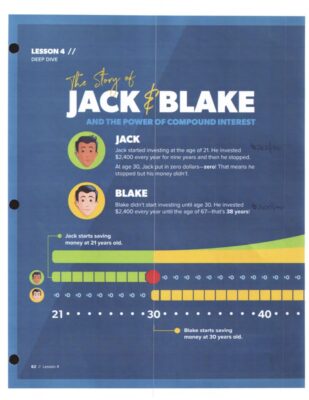

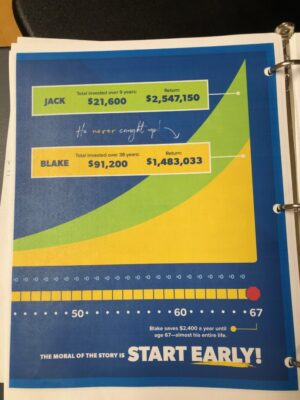

Take a look at this graphic from Financial Peace University detailing the power of compound interest. Jack began investing at 21 years of age and invested $200 a month for 9 years. That’s $2400 a year for ONLY 9 years, then he stopped and never invested any more. Blake did not begin investing until he was 30 and invested the same amount of money ($200 a month, $2400 a year) for 38 years

How did this turn out for Jack and Blake? Because of the power of compound interest, the $21,600 that Jack invested over the course of 9 years in his 20s grew to $2.5 MILLION by the time he was 67. Blake invested $91,200 over 38 years, but started later and at 67 years of age, his money grew to $1.4 MILLION. Still great return, but Blake did not benefit from compound interest in the same amount that Jack did. So the moral of this story is to start investing early!

It is true that those in their 40s and early 50s have 15-20 years of working life to invest and grow those numbers, but for people in their late 50s and up, $200,000 in retirement funds will not grow enough to last throughout retirement. With that said, the best time to begin investing for retirement is TODAY, no matter your age.

Do you know how much money you need to retire with dignity? I encourage you to take a moment to use the Retirement Calculator at RamseySolutions.com and find out.

No matter your age, if you are not even sure that you make enough money to start investing, click reply and let’s have a conversation about your current finances and what positioning yourself to invest for retirement would look like.

CLIENT TESTIMONIAL

Recently, a couple who have been clients graduated from my 6 month coaching program. They were gracious enough to provide a testimonial about their experience. The Kings are a wonderful family who have truly changed their family tree by the hard work and sacrifice they have done this year. It is such an honor to have coached them on this part of their journey.

When we began coaching with Leah, we were in the middle of a nightmare with our money. Our lives were full of stress, shame, and fear because of the overwhelming debt we carried in spite of the fact that we made good money. From the start, Leah gave us hope that things could be better, even when we had no hope ourselves.

While working with Leah we learned how to budget and hold every dollar we made accountable so that we knew where our money was going. This was life-changing for us. Leah also helped us identify the destructive mindsets that we had around money and break the generational trends that got us in debt. She asked us hard, but important, questions that made us really think about our money choices.

After 6 months of working with Leah, we are almost completely debt free and have a whole new mindset about money. We have hope and peace and breathing room each month in our budget because we no longer live paycheck to paycheck. Because of that, we can bless other people generously. Coaching with Leah has been a blessing to our finances, family, and legacy.

What part of the Kings’ testimonial resonates with you? Are you feeling stress, shame or fear about your finances? If so, I would love to chat with you. Feel free to use the ‘Consultation’ link on this website to schedule time for us to talk. It is absolutely free.

LINKS TO RECENT INTERVIEWS

Recently, I had the pleasure of chatting with and being interviewed by two lovely ladies about what I do as a Financial Coach and wanted to share links to both interviews with you.

The first interview aired on October 27th with fellow financial coach, Suzanne Scullion of G.R.A.C.E Financial Coaching, on her Facebook Live show called Le$$ons Learned: The Dumbest Thing I’ve Ever Done with Money. This was a fun interview where I shared our money story about getting into a large amount of debt and then, finally, becoming debt free. Click the link above to watch it on YouTube.

The second interview aired on November 1st and was with my precious friend, Sharon Tedford of 61 Things, for her podcast, God in the Ordinary. We talked about how I make God known to people through my job as a Financial Coach. You will enjoy this interview simply because of Sharon’s lovely British accent, which hopefully makes up for my Southern drawl! Click the podcast title link above to watch.

Thanks for reading, dear one! I pray these words have been a blessing to you. If I can serve you in any way, please do not hesitate to reach out. My email is [email protected].

SDG/FCA!!